Robust office leasing year ends on soft note as coworking takes pause

JLL’s U.S. Office Outlook recaps a strong 2019 and projects a subdued 2020

CHICAGO, Feb. 12, 2020 – The U.S. office leasing market ended a strong 2019 on a soft note as Q4 saw subdued leasing activity driven by slowing coworking demand. While leasing demand slowed in the last quarter, the year as a whole was characterized by sustained tenant demand, expansion into new supply and a robust development pipeline that now looks to extend the cycle out to 2023, according to JLL’s Q4 2019 U.S. Office Outlook.

“Some of the foundations of the leasing market are shifting, and we expect to see a modest deceleration in leasing activity in the year ahead,” said Scott Homa, JLL Director of U.S. Office Research. “While we expect the market to remain relatively steady, a wave of new construction completions over the next several quarters will push up vacancy and keep rent growth in check. We’re not at an inflection point, but we are seeing movement we have been expecting for several quarters.”

For example, net absorption spiked to a cycle-high of 67.3 million square feet in 2019 as large tech occupiers expanded into their new, pre-leased Class A spaces. However, absorption in 2020 is expected to moderate as a wave of new deliveries lead to givebacks and near-full employment makes additional headcount expansion more challenging.

Coworking activity slows, deliveries enter final stages

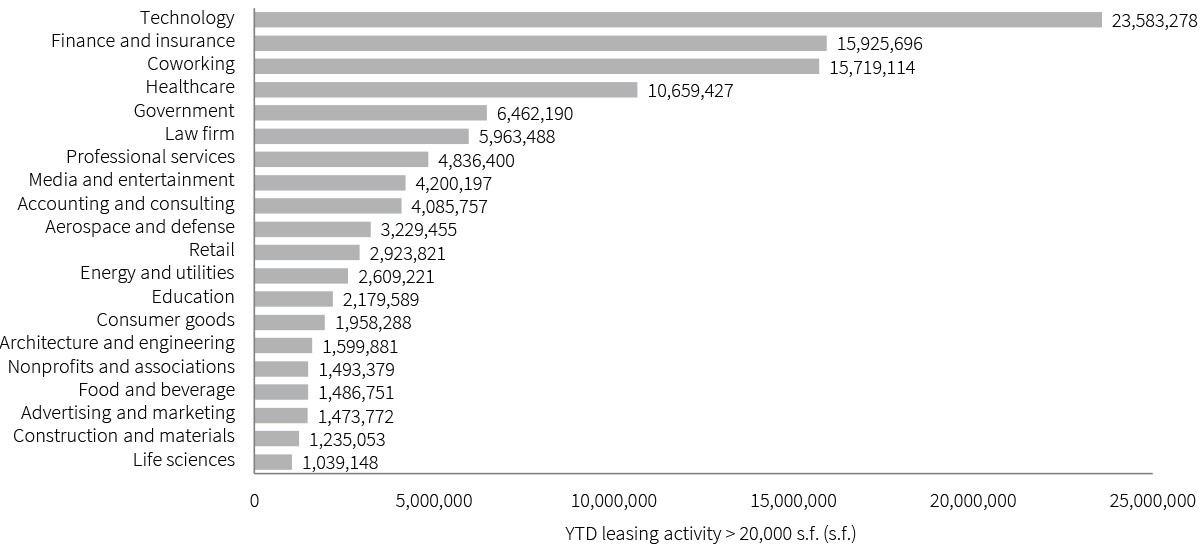

The technology sector served as the driving force for leasing volume in 2019, totaling nearly 8 million square feet more activity than the next closest sectors: finance and coworking. Coworking had been vying to become the top driver of leasing in recent quarters, but headwinds nearly grounded the sector’s activity to a halt in the fourth quarter.

Coworking’s drop-off in Q4 led to technology outpacing all other sectors by a wide margin in 2019

Growth largely took place in fast-growing tech and Sun Belt markets. As a result, Austin, Boston Charlotte, Dallas, Houston, Phoenix, San Francisco, Seattle and Silicon Valley accounted for 43.7 percent of total net absorption in 2019.

Vacancy ticks up as rent growth remains steady

Vacancy rose slightly to 14.3 percent in the fourth quarter, a trend that will likely continue as give-backs spike. Through 2020, 9.6 million square feet of office space will free up in blocks larger than 250,000 square feet in primary markets alone. By 2024, that number will total 23.3 million, which will contribute to further upward pressure on vacancy rates.

Meanwhile, rent growth softened once again in Q4 to 0.6 percent compared with 0.9 percent the previous three quarters. 2019 registered 3.1 percent rent growth, driven in large part by stabilization and correction in suburban office markets, which saw big gains last year as new, vacant blocks of space hit the market.

“We’re noticing a wider spread between asking rents and net effective rents given rising concession packages across most markets,” said Homa. “We believe deal economics are stabilizing in most U.S. markets as large blocks of pre-leased, new space gets filled and give-back of second-generation space mutes gains from the higher-priced deliveries.”

For more content, visit The Investor, an online news source providing real-time commercial real estate news to asset buyers and sellers around the world. For more news, videos and research resources on JLL, please visit the firm’s U.S. newsroom.

About JLL

JLL (NYSE: JLL) is a leading professional services firm that specializes in real estate and investment management. JLL shapes the future of real estate for a better world by using the most advanced technology to create rewarding opportunities, amazing spaces and sustainable real estate solutions for our clients, our people and our communities. JLL is a Fortune 500 company with annual revenue of $18.0 billion, operations in over 80 countries and a global workforce of more than 93,000 as of December 31, 2019. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit jll.com.